Introduction: Understanding the One-Stage Dividend Discount Model (DDM)

There

are many models in finance to value a company’s stock depending on its future

dividends, including the One-Stage Dividend Discount Model (DDM). This model

operates under a simple premise: that values a stock as the value of all the

future dividends assuming the growth rate of the dividends is constant. In

other words, according to the Dividend Discount Model, the value that a firm

has for an investor equals the present value of future cash flows in the form

of dividends. The formula for the One-Stage DDM is:

Where:

- P0

is the current stock price

- D1

is the expected dividend for the next period

- r is

the required rate of return (cost of equity)

- g is

the constant growth rate of dividends

In the case of portfolio

management, One-Stage DDM is very essential for students to understand since,

it offers a basic view of equity valuation, and hence, students can be able to

judge whether the particular stock is undervalued or overvalued based on the

future dividend. Incorporated into real portfolio management problems the DDM

gives students an accurate and mathematically correct way to make investment decisions.

To tackle such a complicated model can be overwhelming. By opting for portfolio management assignment help, the students will be able to develop a deeper

understanding of the application of the model including examination of other

assumptions and ways of amending the model to tackle different markets or

company situations thereby enhancing their problem-solving skills.

One-Stage DDM and its Role in Portfolio Management

The one-stage Dividend Discount Model is significant in portfolio management because it establishes

a direct link between dividends and stock price that investors seek. For

students working on assignments or projects related to portfolio management,

this model offers an obvious approach for estimating a company’s real value and

that is especially helpful in the case of stable dividend-paying

companies such as utility companies or blue-chip stocks. It can be specifically

useful in managing long-term capital appreciation investment plans where both

the dividend income and its growth are given prime importance.

In

the case of students working on their research projects and assignments, the

One-Stage DDM can act as an initial frame of reference for the construction of

more refined and advanced models of valuation. The One-Stage DDM is

particularly useful as an introductory tool when learning the concept of stock

valuation before going through other more advanced models or methods such as

DCF analysis. Knowing more about how this model works in the real working environment can equally provide an opportunity to learn how the interest rate, inflation

consideration, as well as company growth potential, influence the prices of stocks.

Getting

our portfolio management assignment helps facilitate students in digging deep

into these topics for a comprehensive understanding. They can find out how the

model is used in various situations like firms experiencing high growth where

the future growth in dividend cannot be ascertained or firms with fluctuating

dividend policies.

Applying the One-Stage Dividend Discount Model to Real Portfolio Management Problems

The

best way to demonstrate the efficacy of the One-Stage DDMs is to work through

the portfolio management problems with it. Below are the examples of how

students can apply this model to their assignment together with the steps:

1. Identifying Stable, Dividend-Paying Companies

The

One-Stage DDM is most appropriate for firms that have stable and sustainable

dividend policies throughout the estimated years. For example, utility firms,

telecoms, and firms in the consumer products industry provide good examples of

consistent and increasing dividends and are usually a reference for the DDM.

Example:

Take for instance Coca-Cola (KO) company, which has consistently paid its

dividends. For fiscal year 2024, the company’s dividend payout is about 3.1%,

while the annual rate of dividend hikes is around 5%. If we assume the required

rate of return for Coca-Cola's stock is 8%, students can calculate its

theoretical stock price using the DDM formula:

From

the same we get the stock price of Coca-Cola to be around $ 61.33 from dividend

alone. This explains how, using the One-Stage DDM, one will arrive at a present

value that can be compared to the stock’s current market price in order to

determine more specifically whether the stock is presently trading at a

discount or premium to the company’s value.

2. Calculating the Amount

of Required rate of return(r)

Consistent

with earlier discussions of the DDM, r is a major determinant of the stock

price calculation and is therefore a key consideration. In this case, the rate

is often forecast by the capital asset pricing model (CAPM) which takes into

account the risk-free rate of return, the beta of the stock in question, and

the expected return from the market. In real assignments, students also use

historical data to estimate r and then implement in the selected company.

For

example, if the student is doing a portfolio project and decides to work on a

company such as Duke Energy (DUK) which pays stable dividends and has

comparatively less volatility. With the help of the CAPM, they assume the cost

of equity is 6 percent, and a dividend growth rate of 3 percent. This can be

used in the DDM formula to value for Duke Energy’s stock.

3.

Model Sensitivity to Growth Rate Assumptions

The growth rate (g) is

usually a difficult one to assess though is very important when using it to

compute the stock value. In DDM, even a small difference in growth rate can

significantly affect the form of the stock prices.

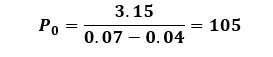

Example: For this

analysis let us assume that a student is analyzing Procter & Gamble (PG).

If the dividend growth rate is assumed to be 4%, with a required return of 7%,

and a next-year dividend of $3.15, the stock price calculation is:

However, if the growth

rate assumption is adjusted slightly to 3%, the price drops significantly:

Using this example,

students learn how volatile the One-Stage DDM is to the changes in growth assumptions

and how they must analyze historical growth trends and company potential to

make proper adjustments.

4. Limitations and

Real-World Adjustments

The One-Stage DDM,

however, is quite easy to apply; nevertheless, some limitations could occur

when applying this model, especially in cases when the company does not pay

dividends regularly, or when the growth rate fluctuates. Students are required

to look at other models like the two-stage DDM or else use others such as

Discounted Cash Flow (DCF) where the emphasis is not on dividends but cash

flows of the firm as a whole.

Advantages of receiving Portfolio Management Assignment Help to the learners

Portfolio

management is a course that challenges students with complex financial models,

complicated case analyses, and tough mathematical problems. This is where

Portfolio Management Assignment Help plays the key role, providing organized

and comprehensive guidance on the relevant concepts and ways to solve

assignment tasks. Not only do students get help with particular tasks for which

they seek assistance but they get exposure to adequate knowledge with the bonus

of learning how to apply such theories in practicable investment scenarios. Our

service provides clear definitions, problems with solutions, and valuable tips

on subjects that may be more challenging for some students working on specific

topics, such as risk analysis, diversification strategies, and valuation models,

which can take the learning experience to a better level.

Using

our service, customers have a chance to get personalized assistance from our

finance specialists. Students receive guidance on complex topics such as the

Dividend Discount Model (DDM) the Capital Asset Pricing Model (CAPM), Modern

Portfolio Theory (MPT), or even the frontier analysis. The kind of teaching

method we employ makes it possible for a student to understand a concept that

he or she may have a lot of trouble grasping.

Besides

the theoretical aspects, we create meaningful learning experiences that develop

practical skills in students. When extending our services, we use tools like Excel

to run a live simulation of the training portfolio, and calculate expected returns,

risk metrics, and the optimal mix of the assets. Some of the topics we cover

include the concept of diversification, risk-return relationship, stock

selection methods in portfolios, and tasks in portfolio management allowing students

to meet real-world challenges. This not only makes them qualify for in-class

work but also fits well in the competency and skills required in the job

market, especially in the financing industry.

We

also help students with computational assignments that include investment portfolio

management, efficiency analysis, sensitivity analysis, Monte Carlo simulations

as well as other computational techniques such as beta determination, Sharpe’s

ratio, portfolio stress testing, etc. From simple linear regression analysis

used in the analysis of stock performance to the knowledge of more advanced

bond measures such as duration and convexity, our expert assistance guarantees

the student expresses a good understanding of tools used in portfolio

management.

With

our Portfolio Management Homework Help, students will be able to handle their

assignments effectively as well as their case studies concerning the subject

and increase their level of knowledge needed to succeed in this competitive

subject area.

Conclusion

In

the process of solving real portfolio management problems using the One-Stage

Dividend Discount Model, students can apply their theoretical learning. The

evaluations carried out to advance the DDM for use by students in stock

selection require aggregate dividend payments, growth rate adjustments, and the

required rate of return on the stock. By availing portfolio management

assignment writing enables the learners to gain different insights and enable

them to understand how portfolio management works in various financial

environments. It also provides them with knowledge of improved methods to solve

DDM and its related models in various firms that can improve their

comprehensiveness during the class and prepare them for practical financial challenges.

Textbooks for Further

Reading

1. “Investments” by Zvi Bodie, Alex

Kane, and Alan Marcus: This textbook offered a sufficient background for

portfolio management students as well as a detailed discussion of the Dividend

Discount Model and Other Valuation Approaches.

2. “Principles of Corporate Finance”

by Richard Brealey, Stewart Myers, and Franklin Allen: A great reference

for learning about financial models and valuation techniques and actual

implementation of the DDM.

No comments:

Post a Comment